Download Why Choose Taxadjusters as a Powerpoint Presentation

Download Why Choose Taxadjusters as a Powerpoint Presentation

| Taxation, not everyone’s favourite subject…..

If you happen to be comfortable with the amount of tax you pay stop reading now. For everyone else read on because the Revenue can be more sympathetic to your business than you first thought.

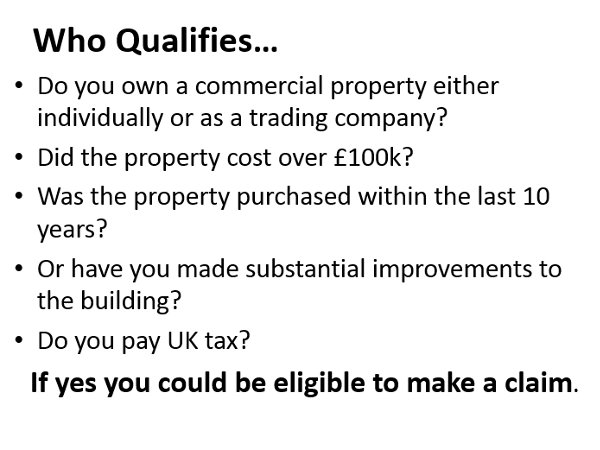

Commercial properties require substantial investment in their property infrastructure whether purpose built by the current owners, or included in the overall acquisition cost. A significant proportion of this building expenditure is regarded by the tax authorities as qualifying plant with which the trade is conducted and the legislation duly allows tax relief against your profits to be claimed for that expenditure.

But surely this relief is already claimed by our accountant as a matter of course?

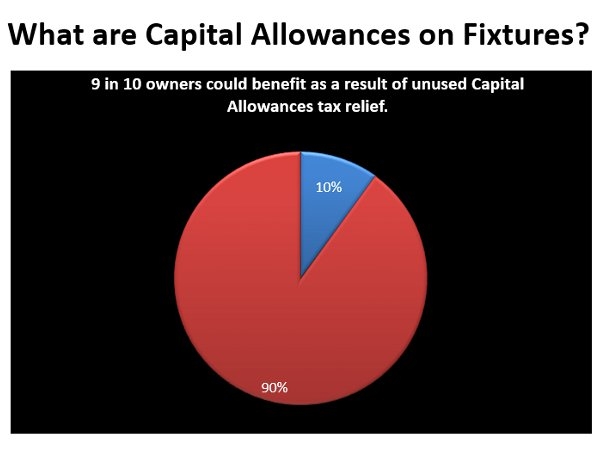

Unfortunately – the answer is “not necessarily”, it depends on the quality of the information provided to them. It is a difficult task for an accountant when considering new or past expenditure as only specific elements of the total spend can be claimed and in the absence of detailed supporting data it can be almost impossible.

Any business that incurs capital expenditure should periodically carry out a Capital Allowance review to ensure full advantage is taken of the reliefs available.

Such a review will identify elements of expenditure where further tax relief can be obtained. The actual date the expenditure was incurred is not a barrier to obtaining relief – subject to documentation still being available. As the equipment, referred to as Fixtures, can still be claimed provided it is still in use within the business.

A Capital Allowance Fixture Review has 3 key elements:

- Extensive due diligence enquiries.

- A detailed site survey of the freehold commercial property to identify the qualifying Fixtures.

- Preparation of a Capital Allowance Valuation Report based upon the survey results using cost values acceptable to the Revenue authorities.

“You deserve a (tax) break”

|

![]() Download Why Choose Taxadjusters as a Powerpoint Presentation

Download Why Choose Taxadjusters as a Powerpoint Presentation